Why Are Schemes Of Quant Mutual Fund Topping The Charts? | ETMONEY

ET Money

View ChannelAbout

ET Money, founded in 2016, is the go-to platform for Indians to invest, manage, and grow their wealth. Over 10 mn+ Indians use ET Money to invest in mutual funds for their life goals, save taxes, secure their retirement with NPS, earn assured returns with FDs & Bonds, build tax-efficient passive income with guaranteed income plans and get instant access to cash without breaking their compounding with Loans Against Mutual Funds. SEBI Registered Investment Advisor. Registration No. INA100006898. BanayanTree Services Limited.

Latest Posts

Video Description

A few weeks back, we received an interesting question on the ET Money youtube channel. We were asked why the different schemes of Quant AMC, their multi-cap fund, their tax saver, mid-cap, small-cap, why are most of their schemes suddenly delivering the highest returns within their respective fund categories? If you haven’t been keeping a track, the equity schemes of Quant mutual fund have done extremely well over the last one year with most then ranked either 1, 2 or 3 for their category. And in this ET Money video, we shall answer the question regarding Quant Mutual Funds. 👉 Chapters 00:00 Introduction 02:23 Quant Active Fund 08:26 Quant Small Cap Fund 12:04 Summary #ETMONEY #QuantFunds 👉 Important links: 6 Ways to measure Mutual Fund risk https://www.youtube.com/watch?v=eU45evtcc90 👉 Subscribe to ET Money Hindi Channel https://www.youtube.com/channel/UCzWtyDo9KmEC1JoAqa1LIEw 👉 To invest in Direct Plans of top Mutual Funds for free, download the ETMONEY app: https://etmoney.onelink.me/unJQ/5ca1ae3b 👉 Read more such informative articles at https://www.etmoney.com/blog 👉 Follow us on: ► Facebook: https://www.facebook.com/ETMONEY/ ► Twitter: https://twitter.com/etmoney https://www.instagram.com/etmoney_official/ https://www.linkedin.com/company/et_money/

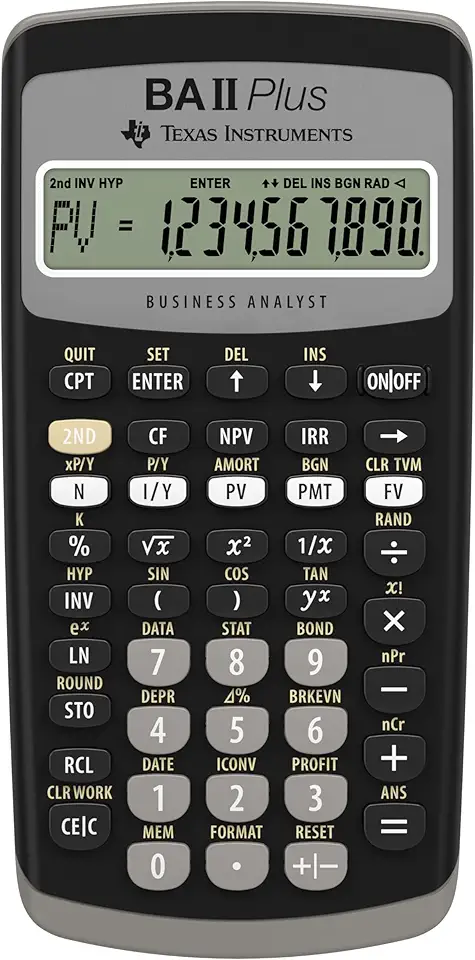

Investment Essentials for Quant Enthusiasts

AI-recommended products based on this video