The Value Investing Delusion | Aswath Damodaran on Why Value Investors Missed the Mag Seven

Excess Returns

@excessreturnsAbout

70% of our viewers haven't subscribed yet. If you like our content, subscribe below. We appreciate it! We take complex investing topics and make them understandable for everyday investors.

Video Description

In this episode of Excess Returns, we sat down with NYU professor Aswath Damodaran to discuss his new book on the corporate life cycle and get his insights on a wide range of investing topics. We cover: - How companies age and why they struggle to act their age - The importance of storytelling in valuation - Aswath's thoughts on factor investing and its limitations - The rise of passive investing and its impact on markets - Market concentration and the dominance of big tech companies - How Aswath approaches his own investing decisions - The potential impact of AI on investing and valuation - Why Aswath has never attended the Berkshire Hathaway annual meeting Aswath shares his unique perspectives on these topics, blending academic rigor with practical insights. He also offers his advice for the average investor, emphasizing the importance of focusing on preserving and growing wealth rather than chasing outsized returns. Whether you're a seasoned investor or just getting started, this wide-ranging conversation offers valuable food for thought on navigating today's complex markets. We hope you enjoy this discussion as much as we did! 0:00 - Introduction to Aswath Damodaran 1:11 - Discussion of Damodaran's new book on the corporate life cycle 4:00 - The importance of storytelling in valuation 7:38 - Examples using Intel and Starbucks 10:14 - Building a business model and the changing skills needed across a company's lifecycle 15:47 - The problem with the concept of a "great CEO" 19:51 - The relationship between narrative and reality in company valuation 23:43 - Value investing and Berkshire Hathaway's annual meeting 26:35 - The dangers of dogma in investing 27:47 - Combating confirmation bias in investing 32:08 - Views on factor investing 40:10 - Market concentration and the dominance of big tech companies 46:58 - The rise of passive investing and its impact on the market 54:00 - Damodaran's approach to his own investing decisions 59:41 - The impact of AI on investing and valuation 1:05:26 - The importance of human insight and creativity in investing 1:06:39 - Damodaran's one key lesson for the average investor SEE LATEST EPISODES https://excessreturnspod.com FIND OUT MORE ABOUT SUNPOINTE INVESTMENTS https://sunpointeinvestments.com/ FIND OUT MORE ABOUT VALIDEA CAPITAL https://www.valideacapital.com FOLLOW MATT Twitter: https://twitter.com/cultishcreative LinkedIn: https://www.linkedin.com/in/matt-zeigler-a58a0a60/ FOLLOW JACK Twitter: https://twitter.com/practicalquant LinkedIn: https://www.linkedin.com/in/jack-forehand-8015094

Essential Finance Books for Value Investors

AI-recommended products based on this video

25 Tests Pack: 20 LH Strips, 4 HCG Strips and 1 QuadSense HCG Cassette. The Most Complete Fast & Accurate Home Fertility Solution for Women. Ovulation & Pregnancy for Both Early Detection & Pregnancy Progress Tracking. Proudly Made in Canada.

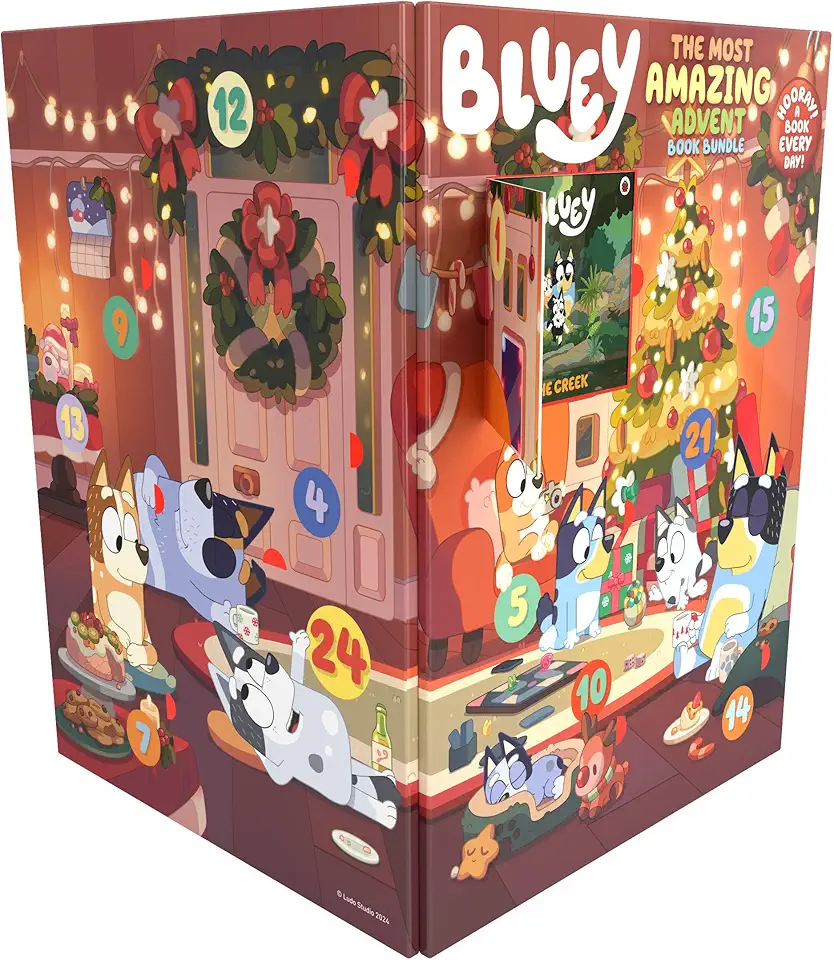

Bluey: The Most Amazing Advent Calendar Book Bundle

Meta Quest 3 512GB — The Most Powerful Quest — Ultimate Mixed Reality Experiences — Get a 3-Month Trial of Meta Horizon+ Included

GEEKOM IT15 Mini PC (3-Year Quality Support) with The Most Powerful 15th Gen Intel Core Ultra9-285H, 32GB DDR5& 2TB M.2 2280 NVMe Gen4*4 SSD, Mini Desktop Win11 Pro, WiFi7/BT5.4/Dual 2.5G LAN/USB4/8K